We’re going to create a cash forecast for your business right here, right now.

Why?

So you can let go of some of that business-owner anxiety you feel when you’re trying to figure out what your bank account will look like six months from now. And so you have some useful information at your fingertips for any time you need to make a smart, CEO-style decision about when to invest in your business.

So — grab one piece of paper and a pencil. (I’ll wait…). If you want to get fancy and set up an Excel spreadsheet, you get 1,000 extra credit points.

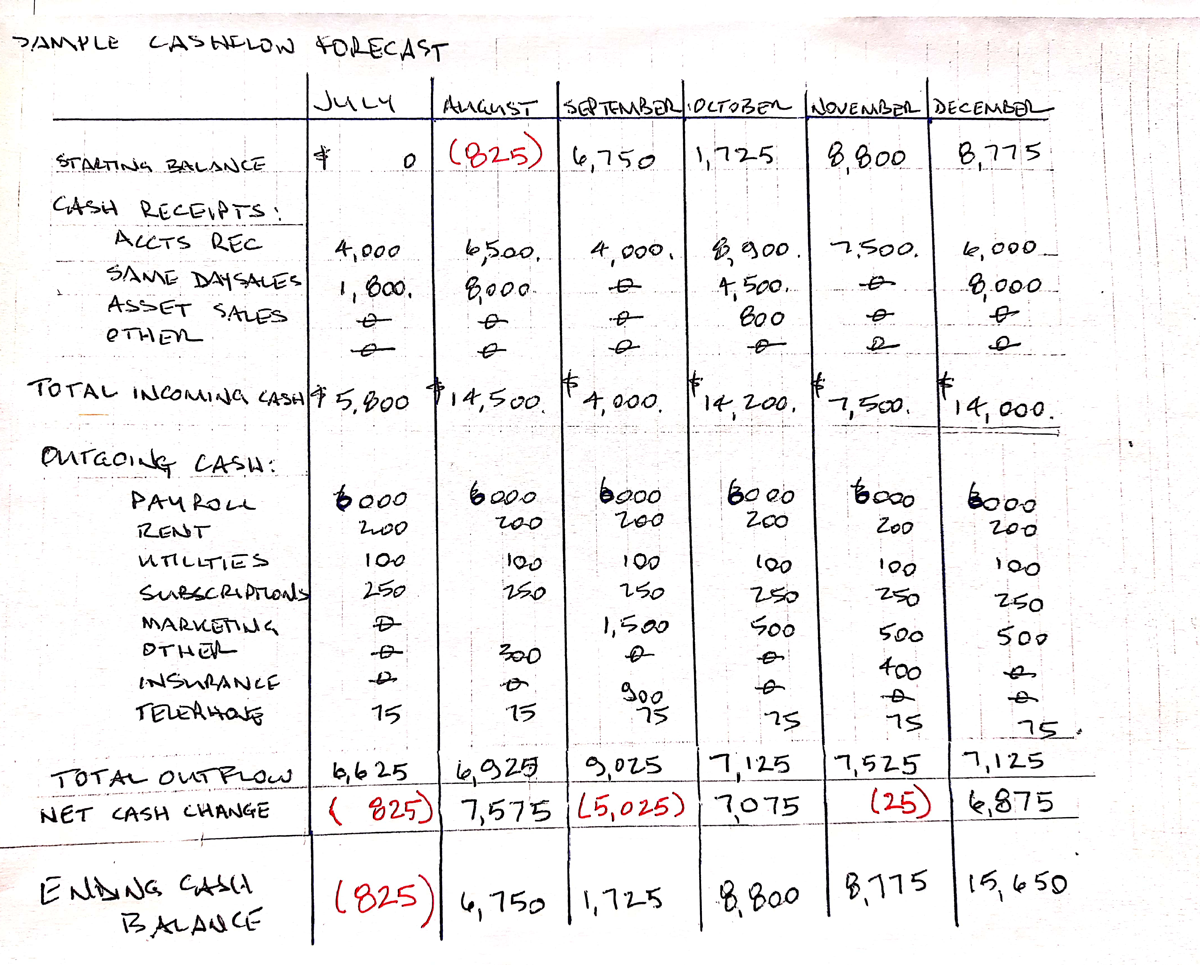

Good. Turn that paper sideways. “Landscape” they call that. Across the top, write down the names of the next six months: July, August, September, etc. Forecasting month-by-month works fine for most small-medium sized businesses unless the cash situation is so tight that weekly is needed (and BTW, in my corporate career it was a daily calculation. Just sayin’). So now you’ve got 6 monthly columns to work with.

Starting Balance

Okay, now your first row across will be each month’s Starting Balance. This is NOT the same as your bank balance… a true ‘cash balance’ is that amount in your reconciled bank balance of your accounting software.. Let’s start from scratch here, and write in zero. Don’t panic. This is just our conservative, safe, cash forecasting starting point!

Incoming $

Your next row is Incoming $. This is money that you believe you’ll receive — not proposal quote amounts, sales estimates or even invoices you’ll send out. Include that first installment of a 3-pay invoice – but only the first installment that you know is coming in. Include whatever regular retainer payments you’ll receive. Look at your accounts receivables and figure out which invoices will actually get paid each month – some clients pay right away, and you know some will wait for 60 days before paying. Incoming $ is money received, not requested (see the difference?). Are you selling any hard assets and collecting the cash for the sale? Add those dollars up and put the number in that Incoming $ row.

Outgoing $ is pretty straightforward. These are the regular bills you pay every month, for rented space, utilities, payroll, subscriptions, etc. You may have some additional, non-routine expenses too: advertising that you only pay quarterly, or an insurance premium that’s due each August. All those dollars shelled out go into your Outgoing $ row.

Good news! No fancy math skills needed. For each month, you take your Starting Balance, ADD your Incoming $ and SUBTRACT your Outgoing $.

That, my friend, gives you an Ending Balance for each month.

Yup – this is super basic. But look how much you just learned:

And that Ending Balance becomes the next month’s Starting Balance.

- You just figured out where your money is coming from.

- You just figured out where your money is going.

- You now have a sense of how much cash is moving through your business.

- You have a sense WHEN cash will come in, and when it goes out.

- You can spot peaks and valleys in your cash receipts and spending.

- Any months where you have low incoming $ and high outgoing $? Now you can plan for that, and put money aside to make sure you have what you need when you need it! No surprises!

- Are there receivables you should be chasing now, to avoid a cash shortage months down the road?

- Do you need a cash trigger – a special offer that can generate some quick cash for your business?

- Do you have a healthy starting balance one month, that you can use worry-free to invest in yourself or your business?

- If nothing changes, how does the rest of the year look?

- If you COULD change something, what would it be?

What did I tell you? That’s a lot of useful information — for a single piece of paper!!!

Now, when you migrate this quick sketch into a spreadsheet, you can start to add details. You can track specific sources of cash, compare your forecasts to what actually happened each month and get better at predicting, start spotting your biggest expenses to make sure your spending makes sense, start calculating your big revenue opportunities and start planning cash triggers for more lucrative months.

Knowledge is power, and this-here piece of paper is just the beginning!